Let's Take Your Business to the Next Level

- You don’t have to pay more than you can afford

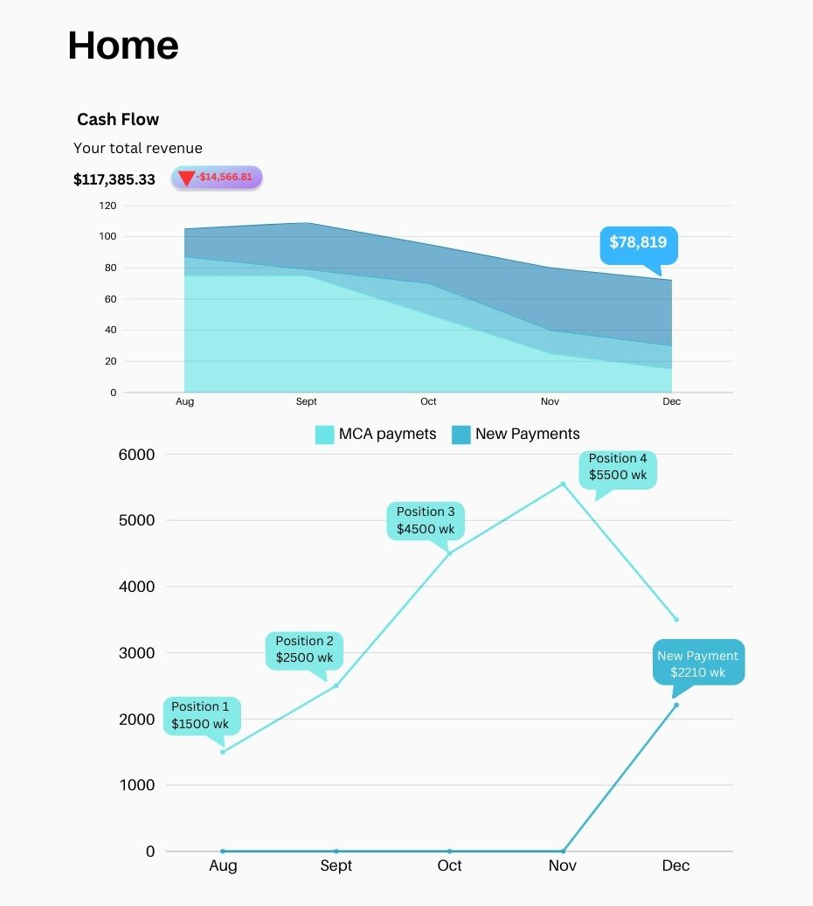

- Reduce Payments by 60% or greater

- Get out of debt in 12-36 months

Get to Know More About Slate

We play a vital role in helping mitigate small business loans in the US by providing corporate restructure and debt management solutions that empower businesses. Here are the type of debts we can help with.

Merchant Cash Advances

These are future receivable agreements where a merchant sells their receivables in exchange for funding.

Learn More ↗

Alternative Bank Business Loans

Alternative loans are typically high interest loans that can crumble a business's cash flow when it needs it the most.

Learn More ↗

Business Credit Cards

Credit cards can be troublesome! High interest rates and annual fees. It's time to make the change.

Learn More ↗

Why Choose

Slate Capital Management?

At Slate, we believe in a proactive and collaborative approach to financial management. Our hands-on team has extensive experience in restructuring and asset management, ensuring that your business not only survives but thrives. Whether you’re facing insolvency, litigation, or simply want to secure your future, we’re here to help.

Industries We Serve

Small Businesses

Hospitality & Restaurants

Retail and E-Commerce

Transportation & Logistics

Healthcare Services

Manufacturing

Client Testimonials

Slate is Stimulating

Business, Supporting Growth

At Slate, we believe in the potential of every business to overcome challenges and thrive. Let us be your catalyst for transformation and guide you towards a brighter and more prosperous future.

Quick Links

Get In Touch

Slate Capital management, © All Rights Reserved.